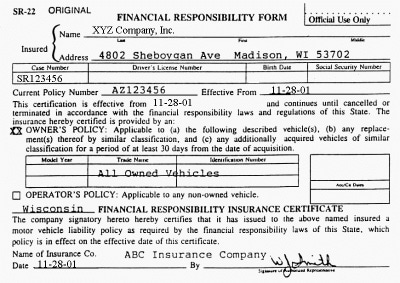

SR-22 insurance is not really insurance. It is a document that proves you carry at least the minimum coverage requirements for Texas. It is also be called a financial responsibility insurance certificate, a SR-22 bond, or a SR-22 form.

Where Do You Get A SR-22 form

Most insurance companies will issue you a SR-22 form for a nominal fee. But you must purchase and maintain the minimum insurance coverage. Even if you don’t own a car, you may still be required to maintain a SR-22 form. There are insurance companies that will sell you auto insurance without vehicle ownership.

In Texas the minimum liability coverage is $30,000 bodily injury per person, $60,000 bodily injury for multiple people, and $25,000 for property damage.

When Do You Need A SR-22 form

In Texas, you may need to obtain a SR-22 form for the following reasons:

- You have been convicted of driving while intoxicated (DWI);

- Your license has been revoked and you are driving under an occupational license;

- You need a hardship license;

- Your license was suspended due to a car crash;

- Two convictions for not having auto insurance; or

- A civil judgment has been filed against you.

Any of the above reasons may require you to obtain a certificate of financial responsibility. You must maintain the certificate for two years from the time the judgment was rendered against you.

You need to maintain your insurance coverage. If you let it slip, your insurance company will notify the state.

Conclusion

Your DWI attorney will advise you to refuse field sobriety testing. Nor do they want you to provide breath or blood to the police. After you refuse, they will take your license. You will need to file for an occupational license.

If you are charged with driving while intoxicated, contact your attorney right away. It will make the process run smoother.

[/et_pb_text][/et_pb_column] [/et_pb_row] [/et_pb_section]